A 43.8% capital gains tax rate is coming.

That’s right – president Biden is eyeing a new tax increase that would raise the tax rate as high as 43.8%. We reported this information late last year and it’s leaking to the media now. The new proposed tax hike would raise the top capital gains tax rate to 43.8% (Cap Gains + NIIT)

Three Rates

There are three rates for capital gains: 0%, 15%, and 20%.

We do not have details on the implementation of the tax increase, and we still don’t know if this will take effect in 2021 or 2022. While some say it won’t pass, it’s likely that something similar will go into effect.

As we saw with the ARP, the proposed bill was very similar to the original version with no significant changes to note.

Do you have any significant capital gains? If so, are you concerned about all the changes coming across?

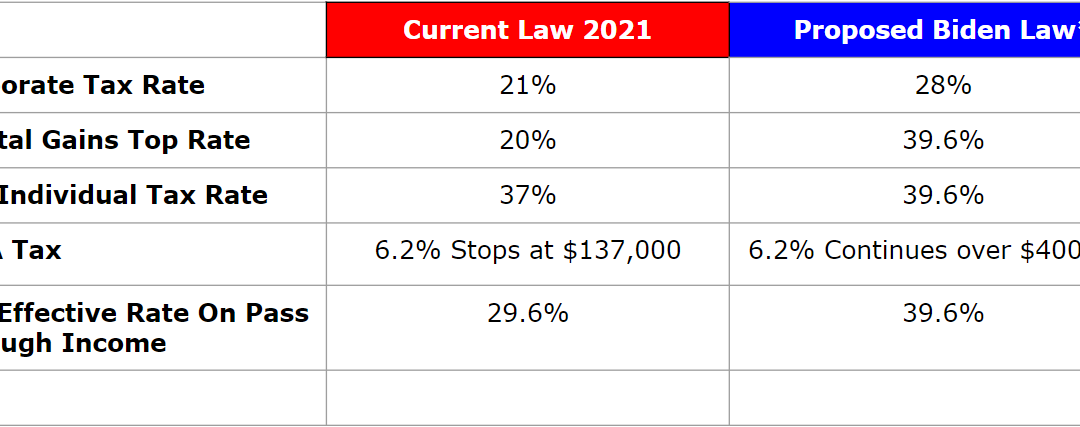

Compare and Contrast

Compare the current 2021 law to the proposed new tax law.

Current Law – no asterisk

Proposed Biden Law – asterisk (*)

Corporate Tax Rate

21%

28%*

Capital Gains Top Rate

20%

39.6%*

Top Individual Income Tax Rate

37%

39.6%*

FICA Tax

6.2% Stops At $137,700

6.2% Continues over $400,000*

Top Effective Rate On Pass-Through Income

29.6%

39.6%*

Estate Tax Rate

40%

45%*

For more specialized tips tailored to you about capital gains tax and more, then our tax planning services are what you need. With over 20 years of experience, we have the knowledge and expertise to guide you in all parts of your financial journey. Contact Palma Financial today. We look forward to serving you! Book Your 2021 and 2022 Tax Assessment here.