by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Oct 16, 2023 | Retirement Planning, Tax Strategy

Welcome to Part 5 of our Tax-Saving Series, where we continue our journey to help you minimize your 2023 tax burden. In this installment, we focus on Retirement Planning strategies designed to secure your financial future. Building a Strong Financial Foundation...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Sep 28, 2023 | Retirement Planning, Tax Planning

Welcome to Part 3 of our Tax-Saving Series, where we continue our journey to help you reduce your 2023 taxes. This installment explores three powerful strategies: S-Corp Election, Reasonable Compensation, and Retirement Planning. Unlocking Tax Savings with S-Corp...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Aug 18, 2023 | Retirement Planning, Tax Strategy

The landscape of retirement planning in the U.S. is constantly evolving. Retirement provisions have been significantly transformed by introducing the SECURE Act in 2019 and the subsequent updates in SECURE 2.0. Let’s delve into the key changes in SECURE 2.0....

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | May 13, 2023 | Retirement Planning, Tax Assessment

Are you tired of spending your golden years in pain and discomfort? While Retirement can be a fulfilling period, it may also present physical obstacles that impede your ability to relish in the activities you cherish. 💔👴🚶♀️ That’s why it’s important to...

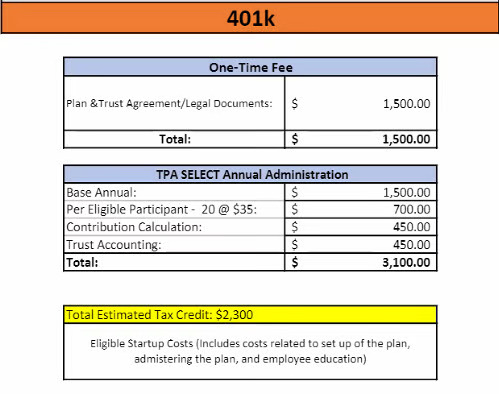

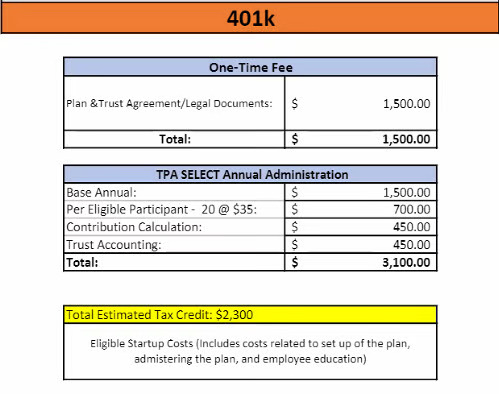

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Nov 29, 2022 | Retirement Planning, Tax Credits

Are you prepared for retirement? It’s not too late to start planning, but time is running out, and if you haven’t started planning for your retirement, you should do that now! Retirement planning is key to having a comfortable lifestyle in your golden...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Nov 17, 2022 | Financial Services, Business Planning, Retirement Planning, Tax Planning

Retirement is one of the most important things in life, but it can happen faster than you realize. Don’t wait until December 31 to secure your year-end retirement deduction!Secure your year-end retirement deduction by establishing a retirement plan before...