There are many reasons why you may want to establish residency in another state, besides the obvious (you just moved).

Maybe you have a child going to an expensive college soon, and you want to establish residency for in-state tuition.

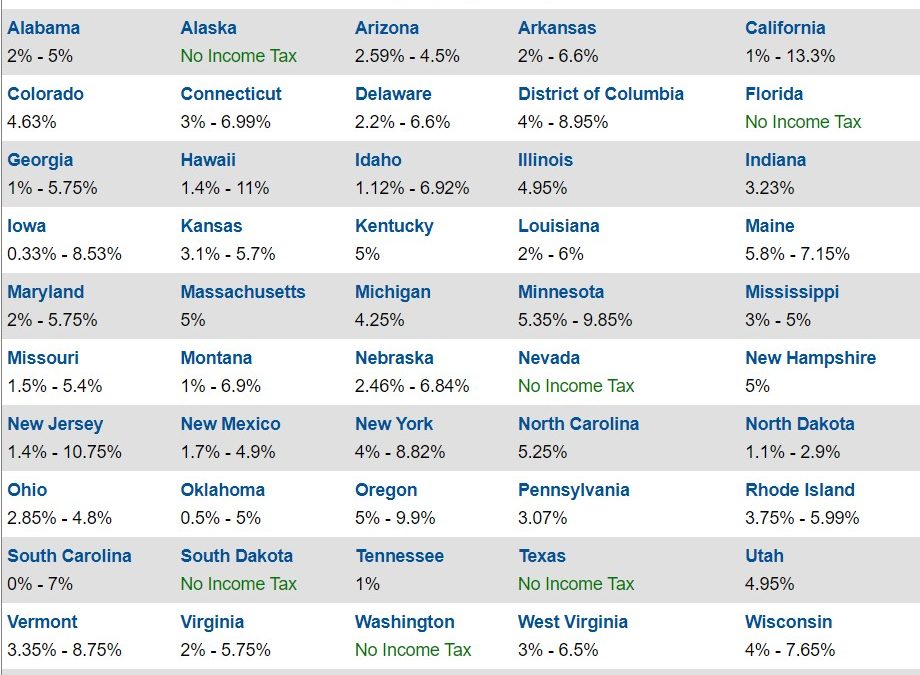

Maybe you’re currently living in a high-tax state, and you want to pay little to no tax in another state.

Maybe you want to move out of the country and realize that some states like California follow you forever for tax.

TAX STRATEGY: Establish residency in a state with no state income tax first

If you postpone the whole thing with multiple homes, at some point, both states (or all of them if you have houses in more than two states) are going to claim you are a resident. And if you die, the estate probate is a nightmare, with every state claiming they have jurisdiction.

It makes sense to determine your state of residency purposely.

Here is some action you should take if you want to claim residency:

- Change your mailing address to the new state,

- Change your driver’s license,

- Change the registration of your cars and other vehicles,

- Register to vote in the new state,

- Open and use bank accounts in the new state,

- File a resident’s tax return in the new state (if required),

- Buy or lease a home in the new state, and

- Change your address on all essential documents such as your investment accounts, insurance policies, credit cards, wills, living trusts, and passports,

It is possible to keep your home in the other state still, but it will look a little fishy if you own a big home in your old state and rent a small apartment in the new home state. In that case, keep a log to show your intent is to establish residency in the new home state.

Need Help? Schedule Your Free Tax Assessment Here.