ProPublica has obtained “a vast trove of Internal Revenue Service data on the tax returns of thousands of the nation’s wealthiest people, covering more than 15 years. The data provides an unprecedented look inside the financial lives of America’s titans, including Warren Buffett, Bill Gates, Rupert Murdoch, and Mark Zuckerberg. It shows not just their income and taxes, but also their investments, stock trades, gambling winnings and even the results of audits.”

Taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share.

The wealthiest individuals in America are dodging their fair share of taxes. A trove of never-before-seen records has been released that reveals the tricks and tactics used to avoid paying income tax. These IRS files show how these savvy taxpayers hide money offshore, take advantage of special loopholes, and even convert their earnings into capital gains, so they don’t have to pay a penny in federal income taxes.

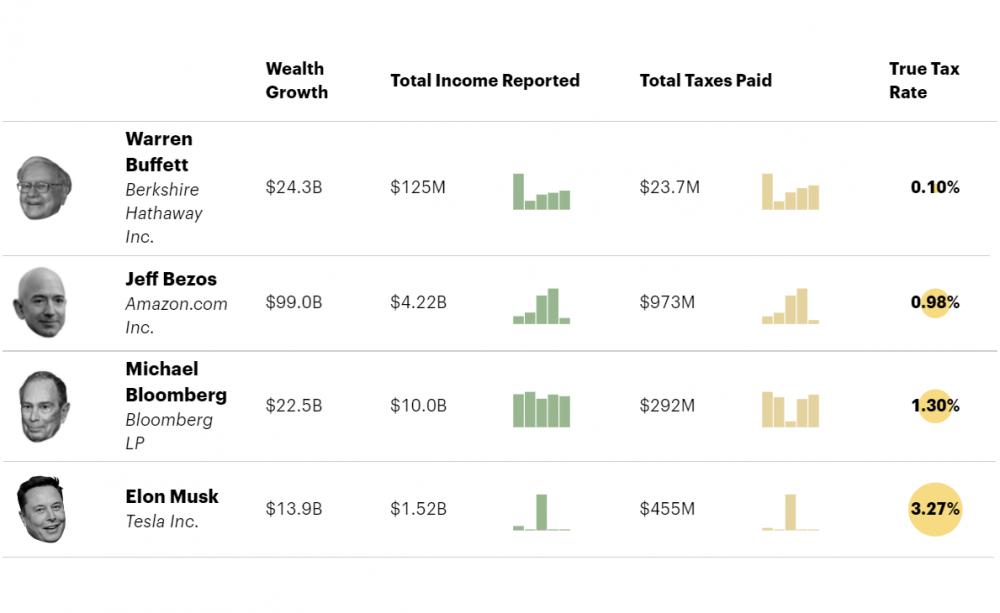

The tax rates of the ultra-rich show the true power of tax planning. The .98% that Jeff Bezos pays is much less than Warren Buffett and Michael Bloomberg pays, which is 1.30%. However, Elon Musk’s 3.27% tax rate seems very high compared to his peers.

Wealthy Americans are always trying to find loopholes in the system to avoid paying their fair share of taxes; this has been going on for centuries. The good news is that you can take advantage of some of the legal loops.

What do the wealthiest Americans have that you don’t? They get to keep more of their money. How? By legally avoiding income tax. They have a solid tax plan that is prepared and implemented during the year.

Are you wondering if you can cut your taxes using some of the same legal loopholes? Yes, you have access to some of the same strategies. To learn more, Book Your Free Tax Assessment Strategy Here.