Learn How to Thrive During the Economic Downturn with Proactive Tax Strategies

Date: Tuesday, August 23

Time: 10 a.m PST / 1 p.m EST

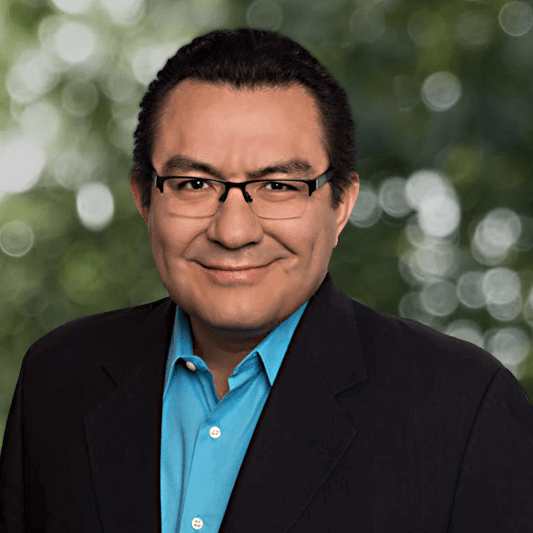

Presenter: Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor

Learn How to Thrive During the Economic Downturn with Proactive Tax Strategies

Date: Tuesday, August 23

Time: 10 a.m PST / 1 p.m EST

Presenter: Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor

It’s no secret that the world is experiencing a downturn in economic activity. Fortunately, there are several tax planning strategies you can implement to help reduce your tax liability and increase your income. We’ll show you how to make it through this difficult time by taking advantage of these simple strategies now!

In this live webinar, you will learn to:

- Analyze business risk and formulate an Action Plan

- Pivot your business for success whenever a crisis arises

- Cash Planning for Recession

- Increase cash flow with tax planning

- Ongoing coaching calls to keep focus during the downturn

You may feel the effects of a challenging economy, but you are not alone. It pays to know what you can do to help yourself thrive. You don’t have to be an expert to file your taxes, but if you want to know more about tax planning, we’re happy to help. With these tips and tricks for making your money work for you, you’ll be able to make your money go further and enjoy peace of mind simultaneously.

Learn How to Thrive During the Economic Downturn with Proactive Tax Strategies

Let Palma Be Your Tax Partner and CFO You Need!

As a Certified Public Accountant (CPA), Personal Financial Specialist (PFS), and a Chartered Global Management Accountant (CGMA), I have the experience and knowledge to save as much money as possible from the government.

In my time with my business, I have helped my clients, just like you, minimize their taxes and look forward to a clear, focused, and well-planned financial future.

Using my decades of experience with the US tax system, I have identified ten significant mistakes filers make when doing their taxes on their own or even with other CPAs or financial professionals. These mistakes can be easily avoided or fixed, and the guide that I have created can help you navigate common pitfalls.

Our team can help you implement over 60 court-proven strategies to cut your taxes.