Recession Proof Your Business with Tax Planning.

Date: Tuesday, August 9

Time: 10 a.m PST / 1 p.m EST

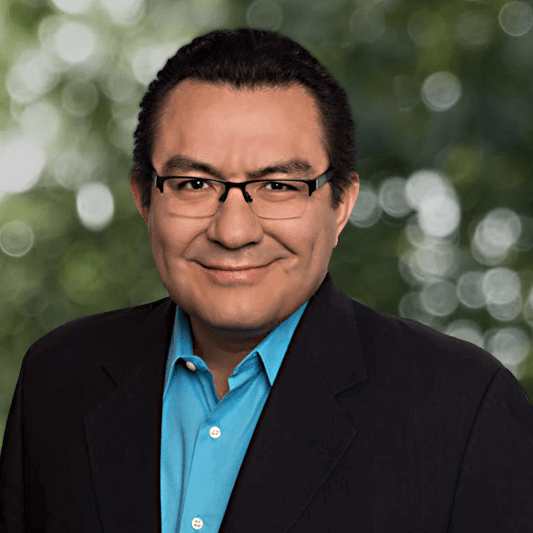

Presenter: Miguel A. Palma, CPA, PFS, CGMA

& Tax Advisor

Recession Proof Your Business with Tax Planning.

Date: Tuesday, August 9

Time: 10 a.m PST / 1 p.m EST

Presenter: Miguel A. Palma, CPA, PFS, CGMA

& Tax Advisor

Tax planning is an essential process for your business and net worth – ESPECIALLY during a recession.

Right now, inflation is everywhere, and it’s KILLING your purchasing power.

If you earn the same this year as last year, even if you increase revenue by 10%, you are still taking a big pay cut.

Join us LIVE to learn tax-busting strategies that could cut your taxes in 2022 and recession-proof your business.

In this live webinar, you will learn to:

- How to improve your cash flow plan immediately

- NOLs – How Can NOLs Improve Your Cash Flow? Carrying back NOLs will enable you to recover past tax payments and result in a tax refund, thus boosting your current cash flow.

- Track marketing key performance indicators (KPIs) (ARR and MRR)

- Know your liquidity options (ERC and Reasonable Compensation)

- Overpaying Income Taxes – How Much Are You Overpaying In Quarterly Taxes & Withholdings, That You Can Start Reducing Today?

- Runway – How Much Cash Do You Have To Cover Your Expenses If You Brought In No More Business?

You have to start with the low-hanging fruit, overpaying in taxes. And that’s where we can help. In running through this exercise, we have saved our clients $18,279,590 in taxes and are just getting started.

Recession Proof Your Business with Tax Planning.

Let Palma Be Your Tax Partner and CFO You Need!

As a Certified Public Accountant (CPA), Personal Financial Specialist (PFS), and a Chartered Global Management Accountant (CGMA), I have the experience and knowledge to save as much money as possible from the government.

In my time with my business, I have helped my clients, just like you, minimize their taxes and look forward to a clear, focused, and well-planned financial future.

Using my decades of experience with the US tax system, I have identified ten significant mistakes filers make when doing their taxes on their own or even with other CPAs or financial professionals. These mistakes can be easily avoided or fixed, and the guide that I have created can help you navigate common pitfalls.

Our team can help you implement over 60 court-proven strategies to cut your taxes.