The S Corporation Owner’s Guide to Reducing Taxes: 9 Proven Strategies to Save BIG

Date: March 1st, 2023

Time: 10 a.m PST / 1 p.m EST

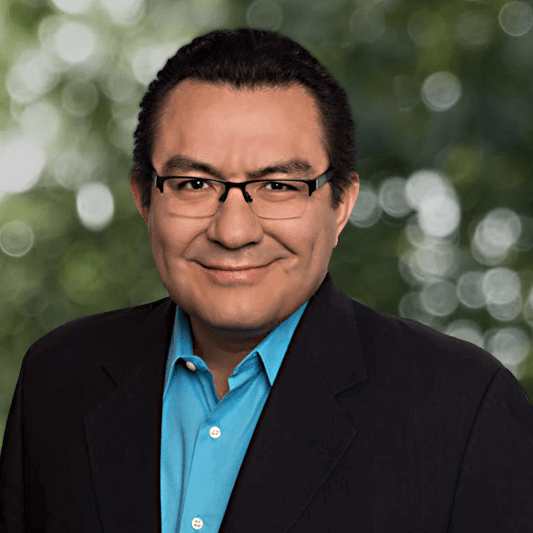

Presenter: Miguel A. Palma, CPA, PFS, CGMA

& Tax Advisor

Are you tired of paying high individual income taxes as an S Corporation owner? Join us for a game-changing webinar where you will learn the secrets to maximizing your savings and reducing your taxes.

In this webinar, you will discover:

- 9 proven tax strategies specifically designed for S Corporation owners

- How to optimize your salary and maximize your income as distributions

- How to avoid the typical mistakes all S Corp owners make

- The steps to establish a tax-free health insurance plan for yourself and family

- How to utilize your home and your S Corporation to pay less in tax

- How to maximize your tax situation with home-office expenses and behaviors in your S Corporation for big tax deductions

- How to create tax-free benefit deductions for you and your family

- And more!

Don’t miss this opportunity to join the exclusive group of S Corporation owners who have unlocked the secrets to maximizing their savings and reducing taxes. Register now and be one of the few who will benefit from these proven strategies. Envy the results of your peers and make the smart move to register today!

The S Corporation Owner’s Guide to Reducing Taxes: 9 Proven Strategies to Save BIG

Let Palma Be Your Tax Partner and CFO You Need!

As a Certified Public Accountant (CPA), Personal Financial Specialist (PFS), and a Chartered Global Management Accountant (CGMA), I have the experience and knowledge to save as much money as possible from the government.

In my time with my business, I have helped my clients, just like you, minimize their taxes and look forward to a clear, focused, and well-planned financial future.

Using my decades of experience with the US tax system, I have identified ten significant mistakes filers make when doing their taxes on their own or even with other CPAs or financial professionals. These mistakes can be easily avoided or fixed, and the guide that I have created can help you navigate common pitfalls.

Our team can help you implement over 60 court-proven strategies to cut your taxes.