What are the Good, The Bad, and The Ugly of the Inflation Reduction Act (IRA) for Business Owners and Individuals

Date: October 19, 2022

Time: 10 a.m PST / 1 p.m EST

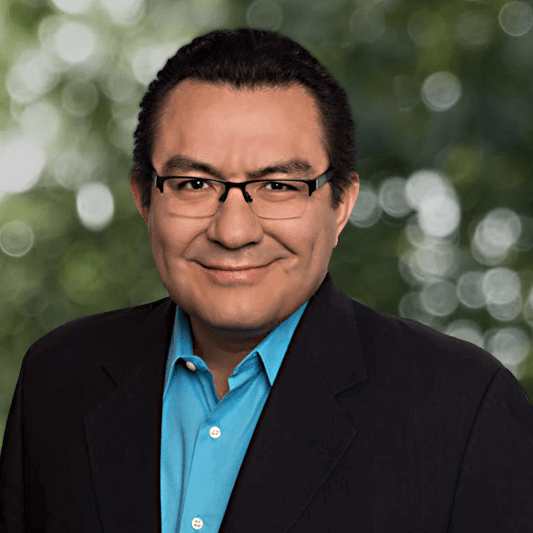

Presenter: Miguel A. Palma, CPA, PFS, CGMA

& Tax Advisor

What are the Good, The Bad, and The Ugly of the Inflation Reduction Act (IRA) for Business Owners and Individuals

Date: October 19, 2022

Time: 10 a.m PST / 1 p.m EST

Presenter: Miguel A. Palma, CPA, PFS, CGMA

& Tax Advisor

President Biden signed the Inflation Reduction Act (IRA) of 2022 Into Law!

We will answer the following questions and more:

-Is it true that the IRS is getting ready to go Beast Mode with the additional funding?

-Does the Act add more IRS agents?

-What are the IRA small business’s benefits?

-Are the Inflation Reduction Act Credits Retroactive and Refundable?

-What are the Electric Vehicles Credit in the Act?

-What are the small business credits in the IRA?

-How does the new Law affect taxes?

-Are there any new credits in the Inflation Reduction Act for landlords and homeowners?

-When does the inflation reduction act go into effect?

You will learn what the Wall Street Journal, CNN, and Fox News are not telling you about the IRA.

The Inflation Reduction Act of 2022 includes:

- Increase IRS funding by $80B to increase compliance by expanding the audit rate and enforcement

- Introduces a Corporate minimum tax rate of 15%

- Increases the Research and Development Credit from $250K to $500K.

- Extends the COVID relief for ACA premiums until 2025

- And More!

So what does this mean for you? In this live webinar, you will learn:

- New credits may mean new opportunities for savings

- If your gross income is above 400k per year, you may see an increase in your taxes in the coming year.

- The bill aims to fight the rising inflation costs to lower costs to American consumers in the long term.

- What taxpayers should do to mitigate their exposure to the IRS

What are the Good, The Bad, and The Ugly of the Inflation Reduction Act (IRA) for Business Owners and Individuals

Let Palma Be Your Tax Partner and CFO You Need!

As a Certified Public Accountant (CPA), Personal Financial Specialist (PFS), and a Chartered Global Management Accountant (CGMA), I have the experience and knowledge to save as much money as possible from the government.

In my time with my business, I have helped my clients, just like you, minimize their taxes and look forward to a clear, focused, and well-planned financial future.

Using my decades of experience with the US tax system, I have identified ten significant mistakes filers make when doing their taxes on their own or even with other CPAs or financial professionals. These mistakes can be easily avoided or fixed, and the guide that I have created can help you navigate common pitfalls.

Our team can help you implement over 60 court-proven strategies to cut your taxes.