Let’s talk about IRA.

Did you know that a self-directed IRA is the same as a traditional IRA and is subject to the same rules? The income the investments in your IRA earn is not taxed until you take distributions, but distributions before age 59 1/2 are subject to a 10 percent penalty unless an exception applies.

You can also have a self-directed Roth IRA for which distributions are tax-free after five years.

But you must avoid self-dealing, and other prohibited transactions or your self-directed IRA could lose its tax-advantaged status.

Question: Is it difficult to establish a self-directed IRA?

Answer: It doesn’t need to be too difficult.

Related Reading: Get Your Kid Started With an IRA

Question: How can I establish a self-directed IRA?

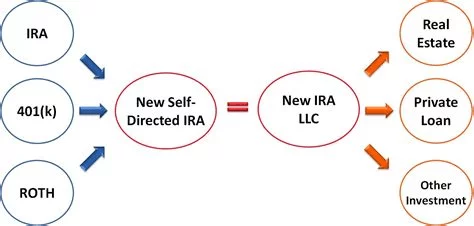

Answer: You first open an account with a custodian that offers self-directed investments. You can also acquire checkbook control over your self-directed IRA by forming a limited liability company to own all the IRA investments.

Keep in mind: Investing in alternative assets such as cryptocurrency is riskier than stocks, bonds, and mutual funds.

- As you’ve seen with recent returns for cryptocurrency investors, the rewards can be significant.

- And the damage to your investment portfolio can be substantial, as we’ve also seen over the years.

When it comes to alternative investments, you need to know what you are doing: Schedule Your Free Assessment.