Important News: The SBA has stopped accepting new PPP applications. Yes, you read that correctly. The Small Business Administration (SBA) has run out of funds and has stopped accepting new applications for Paycheck Protection Program (PPP) loans from most lenders. However, they are still approving EIDL loan applications.

There is approximately $8 billion remaining designated for PPP loans made by community financial institutions. This might seem troubling, but don’t stress out because there is a silver lining. The SBA will continue to accept EIDL loan applications through December 2021, subject to the availability of funds.

Here is the information you need to know pertaining to loan increases:

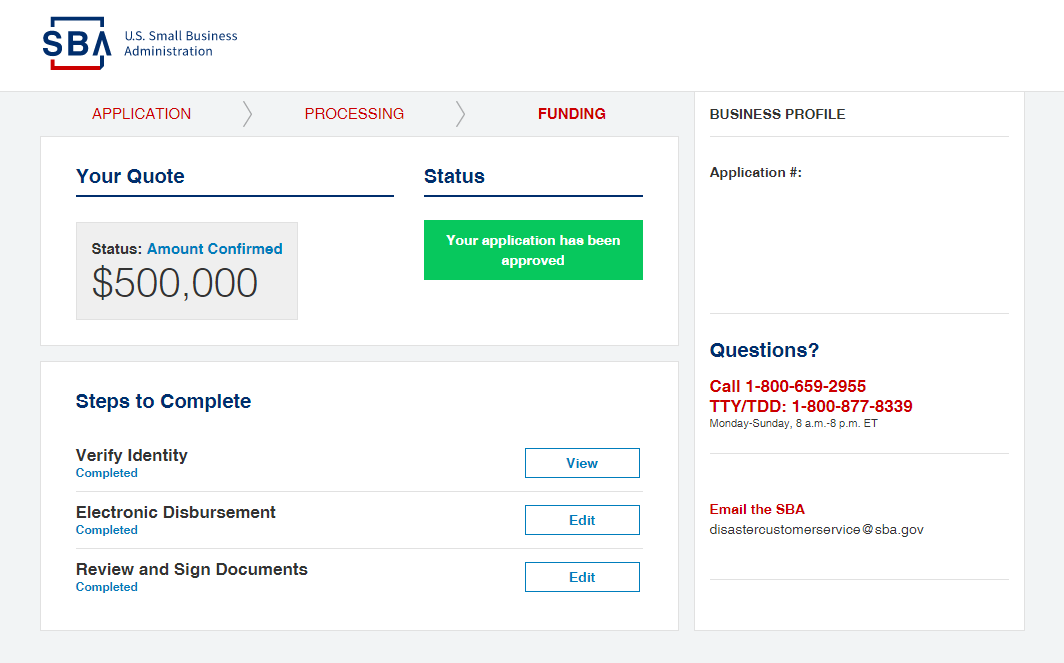

- Loans approved before April 7, 2021, for less than $500,000, are likely eligible for an increase based on new loan maximum amounts announced on March 24, 2021. Businesses that received a loan subject to the previous loan limit can submit a request for an increase at this time.

- It’s a great working capital product for small businesses! Your business can potentially qualify for a term loan of up to $500,000, 3.75% for 30 years paid monthly, and no payments due the first year.

Is Your Business Eligible for the EIDL Loan?

Is your business eligible for the EIDL loan? Check and see if you qualify by using the checklist below. You must have:

1.A personal credit score of 570 or higher is necessary.

2-Sole Prop, Corporation, LLC, Contractors or 1099s.

3-MUST have a 2019 Tax Return.

I’m happy to answer any questions you may have and determine if your business qualifies for this outstanding small business loan!

Our Clients Are Getting Approved

Palma Financial clients are getting approved for the EIDL increased loan limits of up to $500,ooo. Do you think you qualify? Contact us to set up a consultation to find out more. Let’s talk!