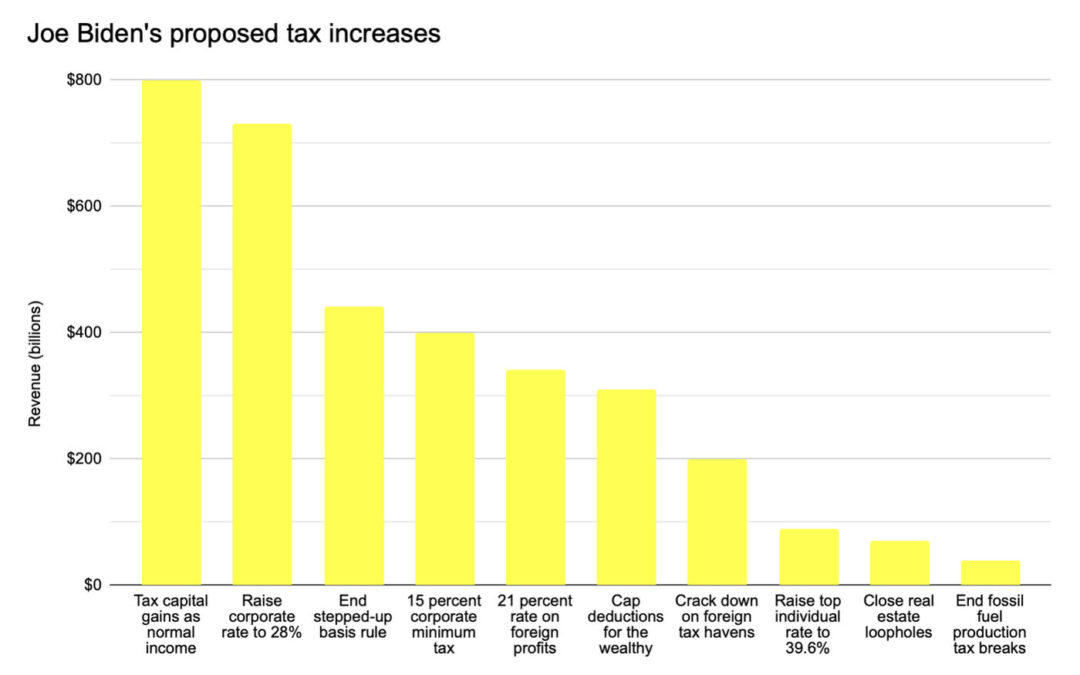

President Biden is planning to float historic tax increase – the highest tax rate on investment gains to date.

Yes, you heard that right. The new administration is getting down to business and it’s happening fast. Here are some of the plans in the works:

Campaign Tax Plan (Proposed)

American Rescue Plan (Passed)

American Jobs Plan (Released, Not Yet Passed)

American Families Plan (Coming Next Week)

Proposed, Not Passed

Remember, much of this is proposed law and not yet passed/enacted. Because of this, you still have time to plan for what may come next. However, because these changes may be retroactive for 2021, it may be a good idea to contact a professional for financial guidance moving forward.

I know you have a lot of questions. You may be wondering if you should plan for Biden tax policy. You may be wondering when it will come. You may be wondering if you should accelerate capital gains in the current year. Here are some additional questions you may have:

- Should I change my legal entity structure now, next year?

- What additional planning strategies should I implement?

- If I make the same income next year as this year, how much more tax would I pay under Biden’s tax changes?

- What things should I do regardless?

- What things should I do if this law is passed?

Luckily, we’re here to walk you through each tax rate change to expect under the Biden Plan and how it will likely apply to you. When we talk, we’ll discuss an overview of the changes, case study examples of how these changes could affect people like you, and what you should consider given the specific facts of your case.

With over 20 years of experience, we have the knowledge and expertise to guide you in all parts of your financial journey. Contact us by phone or online or schedule your initial consultation. If you’re ready to take the guesswork out of your taxes and save money along the way, then our tax planning services are what you need. Book Your 2021 and 2022 Tax Assessment here.