Where is Your Tax Residency?

Let’s start by looking at domicile. The domicile is the place you live. If you leave for a while to work or vacation, it’s where you intend to return. You can only have one domicile, or tax home, at a time.

To change your domicile, you need to:

(1) Leave your prior domicile,

(2) Physically move into a new residence, and

(3) Have an intent to remain and make a home in your new residence.

If you work temporarily in a new area or move into a second home for a short period, you haven’t changed your domicile. You have to show that you have both left your prior home and that you have the intent to stay in your new home.

Let’s look at the tax impact of moves both within the US and from the US to another country as a US citizen. What are your tax obligations?

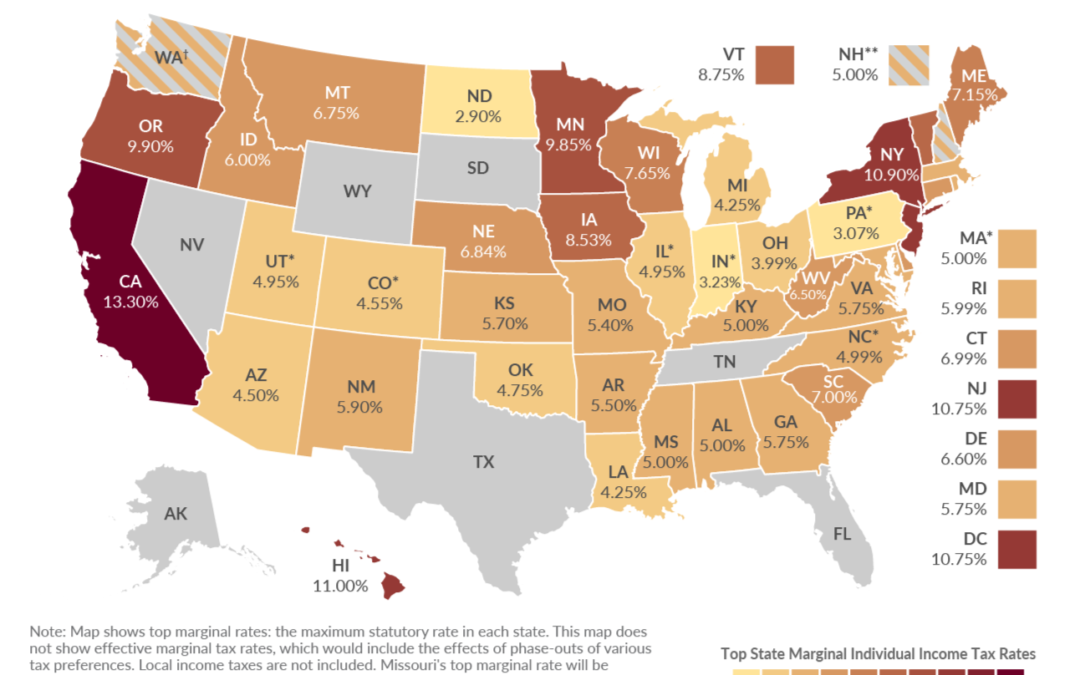

Moving From State to State:

In general, most states look at specific actions to determine whether you have shown the intent to make a home in the new location. They generally will look at:

- Amount of time you have spent in your former state versus the new,

- Location of your spouse and children,

- Where you have made your primary residence,

- Where your driver’s license and vehicles are registered,

- Where your professional license is issued,

- Where you are registered to vote,

- Your mailing address,

- Location of banks and investment accounts,

- Location of professional service providers (doctor, dentist, CPA, etc.)

- Location of religious and community associations,

- Location of real property investments, and

- Location of work assignments.

Some states, like California, monitor social media to see what activities you’re attending and the location from where you post. There is no one rule for every state, and it will depend on your former state of residence and your new state. One thing is for sure, though; it’s not a matter of just getting a post office box in a new state. You must move and change addresses and accounts legitimately and prove you have a new state domicile.

You may also be subject to state tax from your employer’s location if you are an employee. Some states have already worked out how to handle an employee who lives in one state and works in another, and other states haven’t worked anything out, and you’re likely in for a big fight.