ARR vs. MRR, which metric is the ideal KPI for monitoring the health of your Business?

QUESTION #1: What is ARR, and Why it Matters for your Business?

Annual recurring revenue (ARR) is the predictable revenue your Business earns in a year from customers. In other words, it’s an annualized version of your MRR.

QUESTION #2: What is MRR?

Monthly Recurring Revenue (MRR) is the amount of predictable revenue your Business earns each month from customers.

Now, let’s look at the differences between ARR and MRR.

ARR vs. MRR

-The difference between MRR and ARR is time.

-MRR is a metric for early-stage businesses to track contract terms that are less than a year.

– If you multiply MRR by 12, you’ll have your ARR.

-MRR is typically an operating metric, while ARR is more of a valuation metric.

Investors like to see ARR to understand overall business performance. At the same time, MRR shows the more day-to-day operations of a business.

How to Calculate ARR?

As we said before, to calculate ARR, multiply your MRR by 12.

But here is the Annual Recurring Revenue Formula: MRR [Average revenue per customer (monthly) * total number of customers] * 12

ARR can be used for long-term planning, company road mapping, and financial modeling.

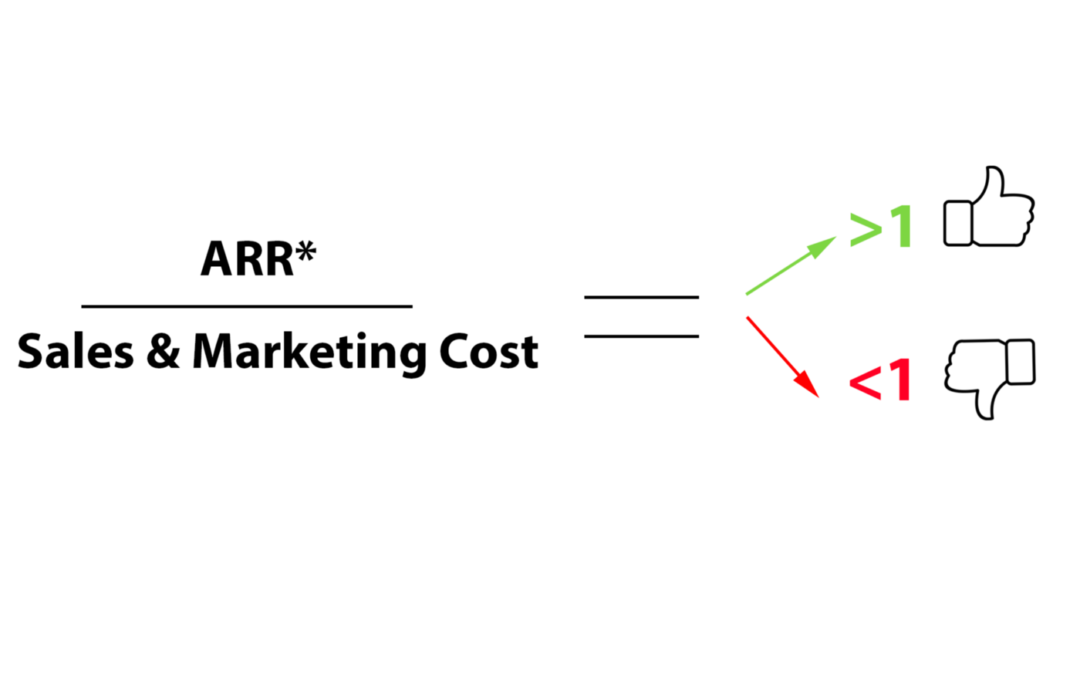

As you grow, ARR will be an excellent benchmark for you to show investors and other stakeholders the impact you have made in the market and how your growth has compounded over time. Some businesses also use ARR to measure business health and performance.

Here are 3 strategies to help maximize ARR:

1- Find Your Ideal Customers:

When creating strategies to sell to prospective customers, this should be the measuring stick you use.

Ensuring your product offering can solve your customers’ pain points will mean more long-term growth for your Business.

2- Invest in Customer Success:

Spend money to make money.

A customer success team ensures that your customers are happy and don’t leave for greener pastures.

3- Play the Long Game:

Short-term wins like incentives may be great, but you should play the long game to achieve larger MRR and ARR.

In the long term, consider annual price increases for your services (especially if you feel you are delivering value and underpricing your product or service).

Let’s talk about your KPIs