Tax Planning for Business Owners, Doctors, Dentists, and Attorneys

Do you operate a business, practice medicine, dentistry, engineering, or law, and wish to stop overpaying taxes to the IRS?

Regardless of your area of expertise, running a small business requires careful planning, especially regarding income taxes. Not overpaying the IRS is crucial to your financial health, and to achieve this goal maximizing your personal and professional tax deductions is a must. However, to ensure you’ve taken advantage of all available tax deductions and loopholes, you need to clearly understand the plethora of tax strategies available to business owners.

So, which tax deductions are available for you as a professional, and which tax deductions should you keep off your income tax returns?

You can use several Proactive Tax Strategies to reduce your tax liability

- Cruises

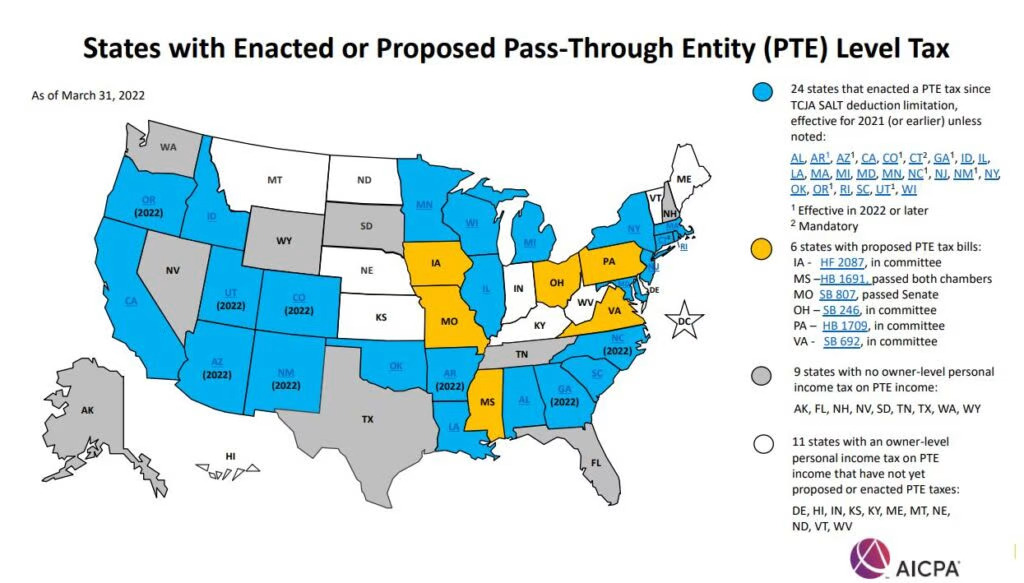

- Pass-through entity (PTE) level tax (SALT Workaround)

- Business Vehicle

- Hiring Children

- Clean Energy Credits

- R&D Expenses

- Retirement Plans

- Cost Segregation

- Accountable Plan

- Hiring Children

- Tax Advisory Services

- CFO Services and Coaching

- Lost deductions from the prior year

- Out-of-pocket charitable expenses

- And more!

Book your free tax assessment here if you are ready to stop overpaying taxes to the IRS