Dr. Jose Andres: A Case Study on Proactive Tax Planning

A Powerful Way to Grow Your Money

(Part I of III)

This article shares a real-life example of the benefits of a defined benefit plan, which may not initially appear like a tax-saving measure to advocate.

What is indeed wrong with the plan? The CPA, who handles the practice’s accounting and taxes, did not ask Andres about his total net worth and available cash. Therefore, he thinks the contribution level is suitable and sufficient because he “needs the cash flow” to survive.

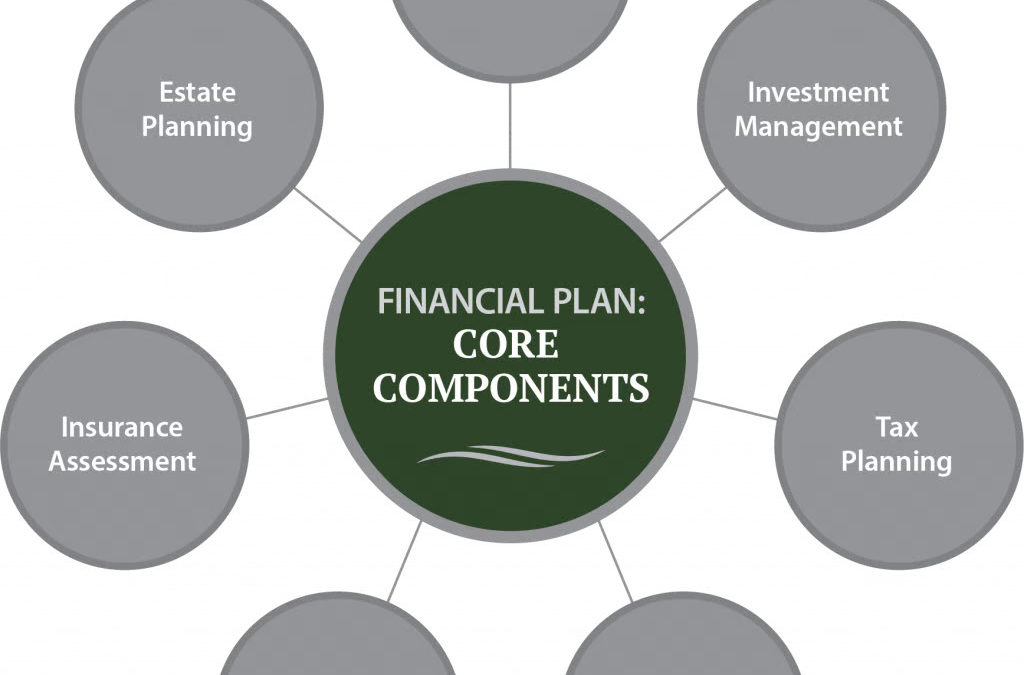

OUR APPROACH: Tax and Retirement Planning: A Powerful Combination

A Defined Benefit Plan is an effective tool as it allows for a significant tax deferral rather than a 401(k) or other defined contribution plan. We took a step back during the proactive tax planning process and looked at the big picture, which was as follows:

Jose’s current deferral felt suitable and sufficient for his practice’s profit level. However, the following important fact pointed to an essential tax planning strategy:

- Jose was in his late 60s.

- Any plan that benefited Jose would also benefit his wife, who worked for the office. The unrelated worker was a lot younger than Jose, and she earned much less money.

- He has a trust with a portfolio of marketable securities valued at over $1 million, which the current CPA is unaware of. Since Jose does not need the cash flow from the dental office for his lifestyle, any cash required to fund a defined benefit plan wouldn’t have to come from the practice.

Our third-party pension expert found that Jose was eligible to establish a DBP and recommended doing so to take advantage of certain benefits.

- His total contributions should be increased to $150,000 from $67,500 (a $82,500 difference).

- Contributions for his spouse should be increased to $50,000 from $36,000 ($14,000 difference).

- The non-related employee’s contribution went from about $3,000 to $6,000 (a difference of $3,000). Jose saved more than $2,400 in taxes due to the employee contribution, bringing the total cost (net out of pocket) down to about $3,600 ($6,000 contribution less $2,400 in tax savings).

Jose found that adding a defined benefit plan to his retirement plan cut his federal and state income tax liability by over $82,400.

STAY TUNED FOR TOMORROW’S NEWSLETTER: We will cover what is wrong with the current plan.