You can spend your money on wages—then claim the Employee Retention Credit and get a big chunk of it back.

Thanks to Congress’ Con App 2021 and the American Rescue Act, the Employee Retention Credit (ERC) has been extended and expanded, making it possible for the ERC to put more money in your pocket than ever before.

Con App makes the ERC available to PPP borrowers retroactively and provides opportunities for additional funds in the future. And the American Rescue Plan Act (ARPA) raises the amount taxpayers can grab back—as long as they know how to play the game.

Get the maximum cash from the new rules. You could spend hours trying to understand the complexities of the revamped ERC, or you can let us do the heavy lifting for you.

So what can you do to take full advantage of the new legislation?

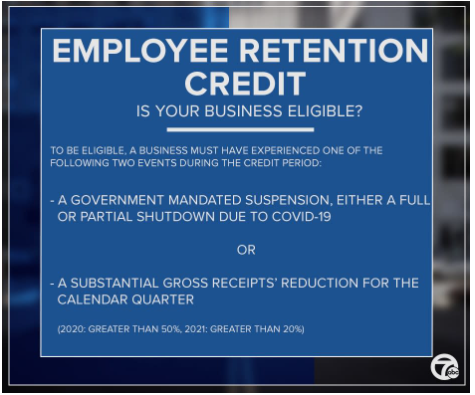

How will you know if you qualify under the new rules?

How will ERC funds affect your tax returns?

And how does it interact with the PPP forgiveness application?

Here’s just one example of potential savings: A company with ten employees each making $40,000 in wages could get a $50,000 ERC for 2020 and $280,000 ERC for 2021!

It’s even possible for you to get complete PPP forgiveness at the same time.

We are Here to Answer Your Questions Via Chat, Email & Phone Calls! We Cater To Small Businesses To Keep America Running With Personal Service.

If you have questions on qualifying for the ERC, please don’t hesitate to book your Free Tax Assessment Here.