East Bay accountants offer a full range of accounting services for businesses and individuals, including tax preparation, bookkeeping, payroll, and more. Our East Bay accountants provide tax and accounting services to small, medium, and large businesses.

Tax preparation services are typically categorized into three broad categories: basic, intermediate, and professional. Basic tax preparation services can be carried out by individuals with limited knowledge of taxes, such as the self-employed. Professional level services typically require certification and a degree in accounting or tax law.

As you can see it might not be necessary to hire a professional for your simple taxes but if you have any questions or need help filing more complicated returns then it might be worth it to go with the pro!

I want to give you a heads up to let you know that our East Bay accountant Service will be hosting a live webinar on a critical topic facing most business owners today…

When are the tax hikes coming???

My team of East Bay accountants near me and I have decided to put together an in-depth presentation on what has happened and expect in Q4.

And would like to invite you to this free webinar. Here are the details:

Date: December 9th, 2021

Time: 10:00 A.M. PST / 1:00 P.M EST

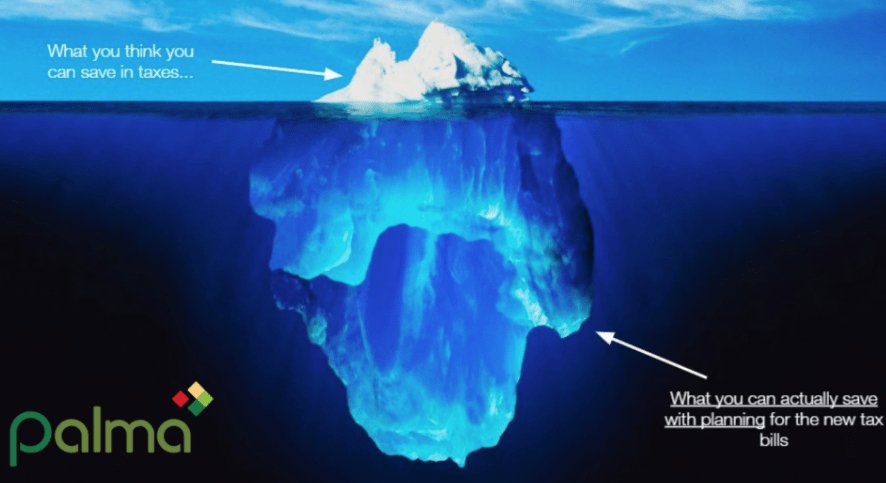

Topic: PLANNING for the TAX HIKES

Presenter: Miguel A. Palma, CPA, PFS, CGMA

Can’t make it? Shoot me a reply with “recording,” and I will make sure to get you the recording as soon as we finish.

Register Here.

See you live!