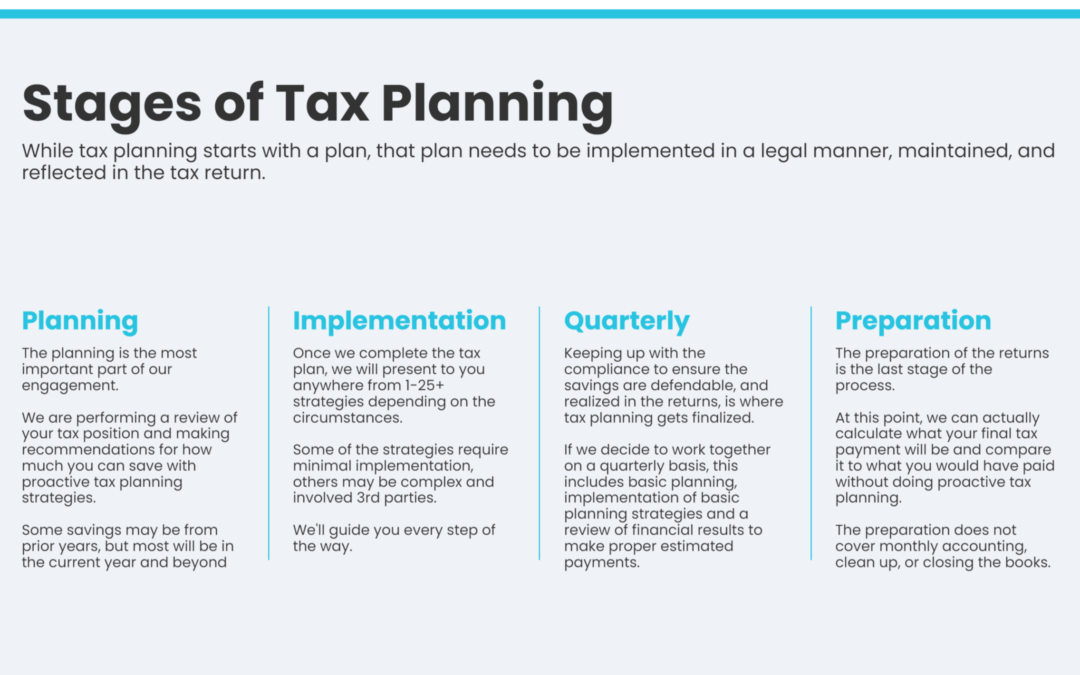

Are you interested in reducing your taxes? The first step to doing so is to create a plan. While tax planning starts with a plan, this plan needs to be implemented legally, maintained, and reflected in the tax return. Here are the steps that we follow.

1- Planning:

Planning is an essential part of our engagement. We are reviewing your tax position and making commendations for how much you can save with proactive tax planning strategies. Some savings may be from prior years, but most will be in the current year and beyond.

2- Implementation:

Once we complete the tax plan, we will present to you anywhere from 1-25+ strategies depending on the circumstances. Some of the strategies require minimal implementation; others may be complex and involved 3rd parties. We’ll guide you every step of the way.

3- Quarterly:

Keeping up with the compliance ensures the savings are defendable and realized in the returns, where tax planning is finalized. If we decide to work together every quarter, this includes essential planning, implementation of basic planning strategies, and a review of financial results to make correctly estimated payments.

4- Preparation:

The preparation of the returns is the last stage of the process. At this point, we can calculate what your final tax payment will be and compare it to what you would have paid without doing proactive tax planning. The preparation does not cover monthly accounting, clean-up, or closing the books.

Are you interested in learning more about this? Let’s discuss more in a strategy session. Book Your Free Tax Assessment Here.