Double Benefits: Claiming Both the ERC and Tax-Free P.P.P.

First, say thanks to the Consolidated Appropriations Act, 2021 (C.A.A.), enacted December 27, 2020. It opened the door (retroactively and as we advance) for P.P.P. participants to claim employee retention credit (ERC).

A friendly reminder: tax credits are the best. They usually reduce taxes dollar-for-dollar. (The ERC is not quite as good as the usual tax credit because you increase taxable income by the amount of the credit. But it’s still very good.)

The CARES Act, enacted on March 27, 2020, created the P.P.P. money, but it prohibited you from getting both P.P.P. money and tax credits from the ERC; you had to choose one benefit or the other. Thanks to the new December law, you can have tax-free P.P.P. money and tax credits from the ERC.

And perhaps the best news of all comes from the I.R.S. in its recently released, business-friendly guidance on how the rules work when you want to claim both P.P.P. and ERC benefits.

How the Law Changed

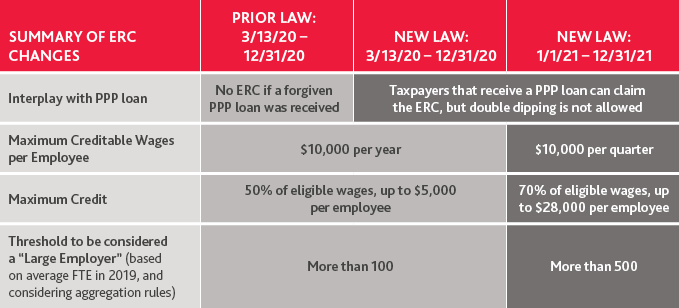

The C.A.A. made four crucial changes retroactive to 2020:

- You may now qualify (yes, retroactively) to claim the ERC for 2020 wages even though you had a 2020 P.P.P. loan.

- You may not claim the ERC on P.P.P. wages used for P.P.P. loan forgiveness.

- You can elect not to claim the ERC to increase your tax-free P.P.P. monies.

- If your lender denies your P.P.P. loan forgiveness, you can claim the ERC for the qualified wages even when you made the election not to claim the ERC for those wages.

Congress made the changes retroactive to March 13, 2020, allowing you to now amend your 2020 payroll tax returns to claim the employee tax credits for which you are eligible.

You likely hadn’t thought of amending payroll tax returns because it’s not common. But you have the three-year statute of limitations for amending payroll taxes just as you have it for your income tax returns.

To learn how to take advantage of these benefits and more, contact us at Palma Financial. With over 20 years of experience, we have the knowledge and expertise to guide you in all parts of your financial journey. Contact us by phone or online or schedule your initial consultation here. We look forward to serving you!