Have you applied for the SBA’s Economic Injury Disaster Loan (EIDL)?

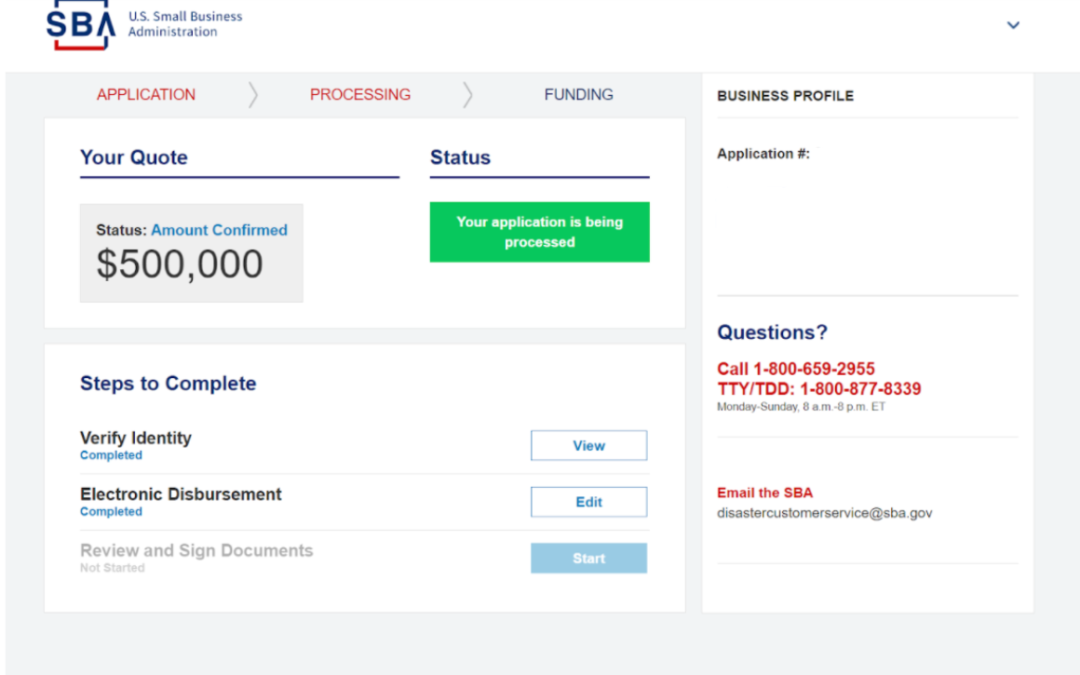

It’s a great working capital product for small businesses! Your business can potentially qualify for a term loan of up to $500K @ 3.75% for 30 years. It is paid monthly and no payments are due the first year.

The EIDL loan is a hot topic on every one of my calls.

If you haven’t applied for it, you should. If you were approved and then declined the loan, then you should consider reapplying. Have questions? We can help you understand the process.

Is Your Business Eligible? See Below:

A personal credit score of 570 or higher is necessary.

Sole Prop, Corporation, LLC, Contractors or 1099

MUST have a 2019 Tax Return.

The SBA also announced extending deferment periods for all disaster loans, including COVID-19 EIDLs, until 2022 to offer more time for businesses to rebuild. To shift all EIDL loan payments to 2022, SBA will extend the first payment due date for disaster loans made in 2020 to 24-months from the date of the note and 18-months from the note for all loans made in the calendar year 2021.

I’m happy to answer any questions you may have to determine if your business qualifies for this outstanding small business loan!

We’re Here to Answer Your Questions Via Chat, Email & Phone Calls! We Cater To Small Businesses To Keep America Running With Personal Service.