I want to do more for you than prepare your taxes this year.

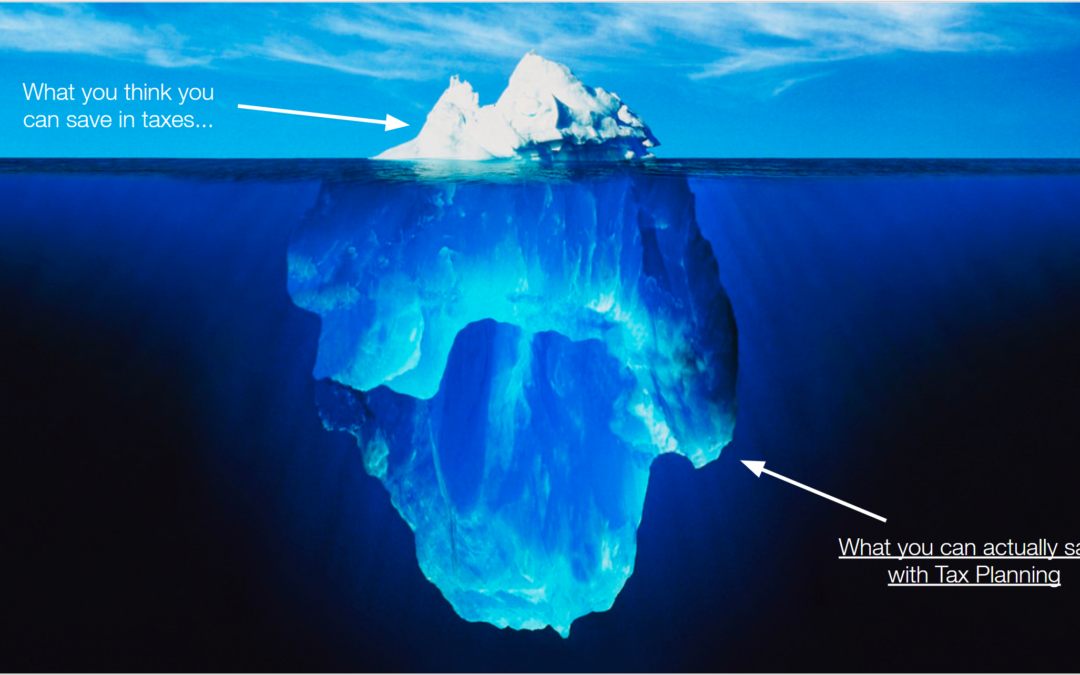

Tax planning goes beyond just tax prep — it optimizes your life and business so you can pay less in taxes.

As you begin to tax plan, you need first to grasp two basic terms.

- Tax deductions: This is what you can subtract from your taxable income. As you look over specific expenses you incur throughout the year, they may be deductible and reduce the amount of income subject to taxes

- Which is better for you this year? Tax Prep or TaxTax credits: This is what can directly lower your taxes. A tax credit of $2,000 lowers your tax bill by $2,000.

Tax planning involves arranging your finances to maximize tax credits and deductions while legally reducing tax liabilities.

This also involves considering the timing of income and purchases.

Of course, these are just the basics.

If you want more information about tax planning and how much you could potentially save, then let’s chat.

I’d be happy to give you a free tax assessment!

Book a time: schedule a time here.