Deductible SALT payments before year-end are a priority for pass-throughs.

Question: Can I pay my individual state income taxes through my business to bypass the state itemized deduction limitation, and get a business deduction?

PROBLEM:

While the $10,000 SALT itemized deduction limit imposed by the 2017 Tax Cuts and Jobs Act spurred lots of unhappiness among people in high-tax states like California, with rates at 13% or higher (the highest is Hawaii’s 11%), there’s no need to fret because ingenuity has always been fundamental when it comes down making lemonade from lemons. We found a workaround to this pesky law that prevents you from deducting your state taxes.

WORKAROUND:

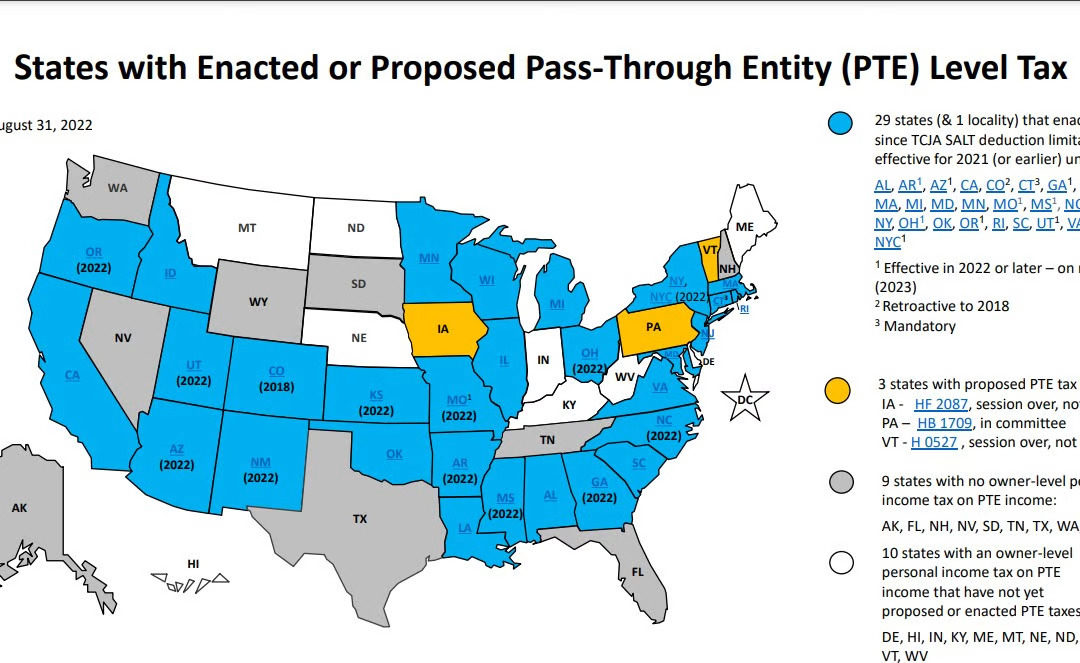

Several states have implemented workarounds in the form of pass-through entities that are able to pay and deduct their state income taxes at an entity level. This effectively bypasses any limits on how much can be claimed by federal taxpayers through individual SALT deductions (for example, $10K).

According to the American Institute of Certified Public Accountants, 29 states and one city have passed a PTET, two states have a proposed PTET legislation in committee, and the remaining 10 states with an owner-level personal income tax on PTET income haven’t yet proposed or enacted a PTET.

Want to take advantage of this workaround? Don’t wait another day!

Make your appointment now and find out with a free consultation.