Bookkeeping Tip: Do you need a last-minute income tax deduction for 2021?

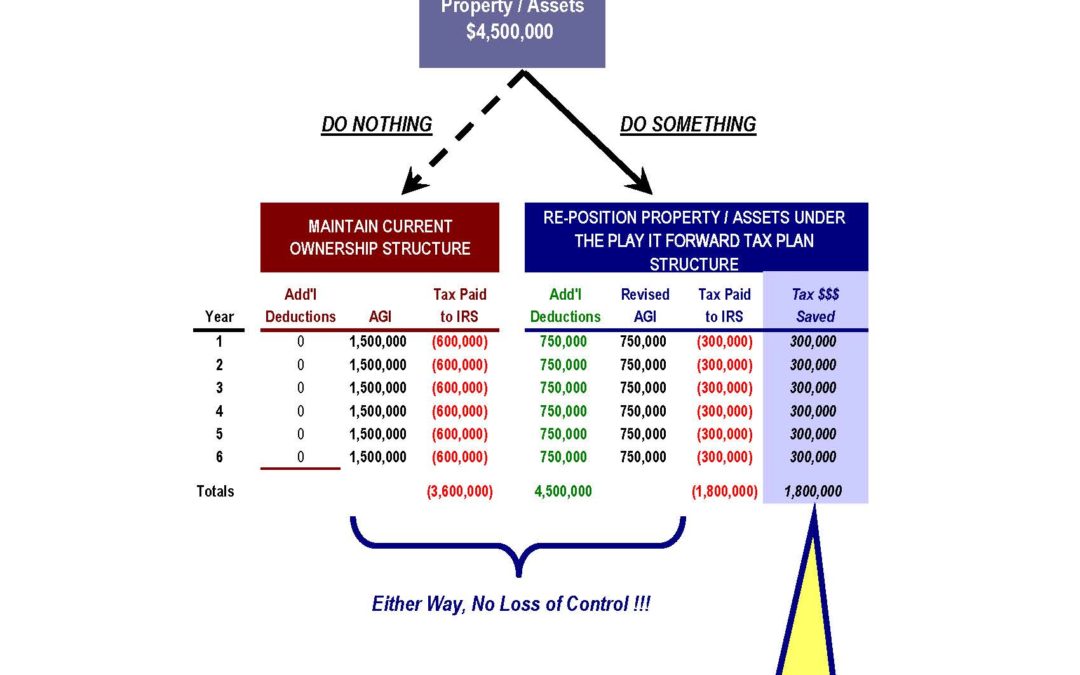

There is still time to create and implement the tax busting reduction strategy, “Play it Forward Tax Plan,” for 2021.

Cash funding is deductible at 50% of your Adjusted Gross Income (AGI).

This bookkeeping tip could cut your 2021 taxes in half.

Funding with long-term capital gain assets (stocks, bonds, mutual fund, real estate, or closely held business assets) is deductible at 30% of your AGI.

Everything in the plan stays under your control in a 99% tax-free creditor-proof environment.

It remains available anytime for your use: tax-free

Some clients with end-of-the-year cash flow issues take short-term loans to achieve the deductions.

Immediate tax-free liquidity means those loans can be quickly repaid after the first year.

It may make sense to fund the plan with the dollars already allocated to make tax payments, and this can reduce taxes by 25% using the actual reserved dollars that will go to the IRS as a funding source for the deduction.

We can implement your decision quickly – right up to December 31.

Book your 2021 Free Tax Assessment Here.