by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | May 1, 2024 | Tax Advisory, Accounting Services, Tax Reform, Tax Resolution

Just talking with someone about how crazy things are in the financial world right now. Everything feels uncertain, you know? That’s why listening to experts, particularly those with a proven track record, is crucial. Leon Cooperman, for example, boasts decades...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Apr 18, 2024 | Tax Evasion, Tax Reform, Tax Strategy

Listen, I know filing taxes jointly makes things easier, but it also means sharing responsibility. What happens if your spouse’s mistakes leave you with a hefty tax bill? It’s frustrating, but something called innocent spouse relief could help. A recent...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Dec 29, 2022 | Tax Reform, Tax Planning

Take advantage of the exciting changes coming with the release of the 2022-2023 Appropriations Bill (also known as the Omnibus). The bill includes a major overhaul called Secure 2.0 that will significantly change individual and small business retirement plans. Here...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Oct 5, 2022 | Webinar, Pro Tips, Tax Planning, Tax Reform

Businesses will See Trillion of Dollars in Growth due to Clean Energy Inflation Reduction Act of 2022 President Biden signed the Inflation Reduction Act of 2022 in August. Credit Suisse predicts Trillions worth of growth due to energy, R&D, and tax credit...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Sep 1, 2022 | Tax Planning, Pro Tips, Tax Bill, Tax Reform, Tax Strategy

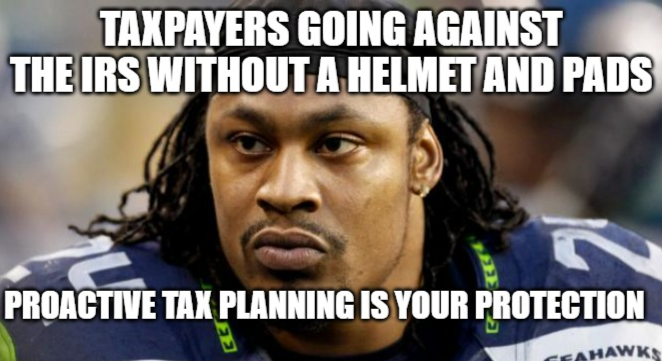

Inside President Biden’s Inflation Reduction Act is $80 billion for the Internal Revenue Service. The Inflation Reduction Act Explained Picture this. It is more than six times the current annual budget ($12.6 billion). The Wall Street Journal described the IRS...

by Jackie Strack | Jun 4, 2022 | Business Planning, Pro Tips, Tax Planning, Tax Reform

Dropping the curtain on entertainment deductions: The meals and entertainment deduction has been tweaked so often that it’s difficult for business owners to know which deductible and disallowed expenses. Here are some meal expense categories you should be...