Are you prepared for retirement?

It’s not too late to start planning, but time is running out, and if you haven’t started planning for your retirement, you should do that now! Retirement planning is key to having a comfortable lifestyle in your golden years.

Don’t procrastinate any longer. It would help if you took action today:

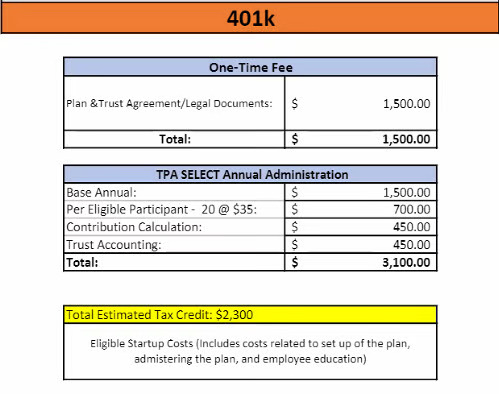

>>> Make the most of the up to $15,000 New and Improved Retirement Plan Start-Up Tax Credit:

You can be eligible for a non-refundable tax credit equal to the larger of the following by starting a new qualifying retirement plan (such as a profit-sharing plan, 401(k) plan, or defined benefit pension plan), a SIMPLE IRA plan, a SEP.

- $500

- Or the smaller of (a) $250 times the number of your non-highly compensated workers who are qualified to participate in the plan, (b) $5,000, or (c) the sum of those two amounts.

The law bases your credit on your “qualified start-up costs.” For the retirement start-up credit, your qualified start-up costs are the ordinary and necessary expenses you pay or incur in connection with

- The establishment or administration of the plan, or

- The retirement-related education of employees for such a plan.

If you’re considering retiring comfortably, now is the time to schedule your free consultation with us! We can help you plan for a smooth retirement transition and ensure you take advantage of all the tax breaks available.

Book Your Free Tax and Retirement assessment here.

Once you’ve scheduled, please reply with “confirmed.”