Auto Deduction has improved in the last 30 years, making it easier for business owners to get deductions.

Changes became effective January 1st, 2018, under the Tax Cuts and Jobs Act (TCJA), including trucks, SUVs, RVs, and even Motorcycles.

The most significant benefit of the current auto deduction is Bonus Depreciation, and it’s still alive and well for 2022. However, it starts to phase out in 2023 and will disappear after 2026.

The Auto Write-off isn’t “Travel.”

The auto write-off is a deduction for business expenses related to owning and using a vehicle. Travel expenses include airfare, hotel, taxi, tolls, parking, Uber, Airbnb, and rental cars.

The Auto deduction can include automobiles, SUVs, Trucks, Motorcycles, RVs, Vans, and Delivery vehicles.

The Actual versus Mileage Method

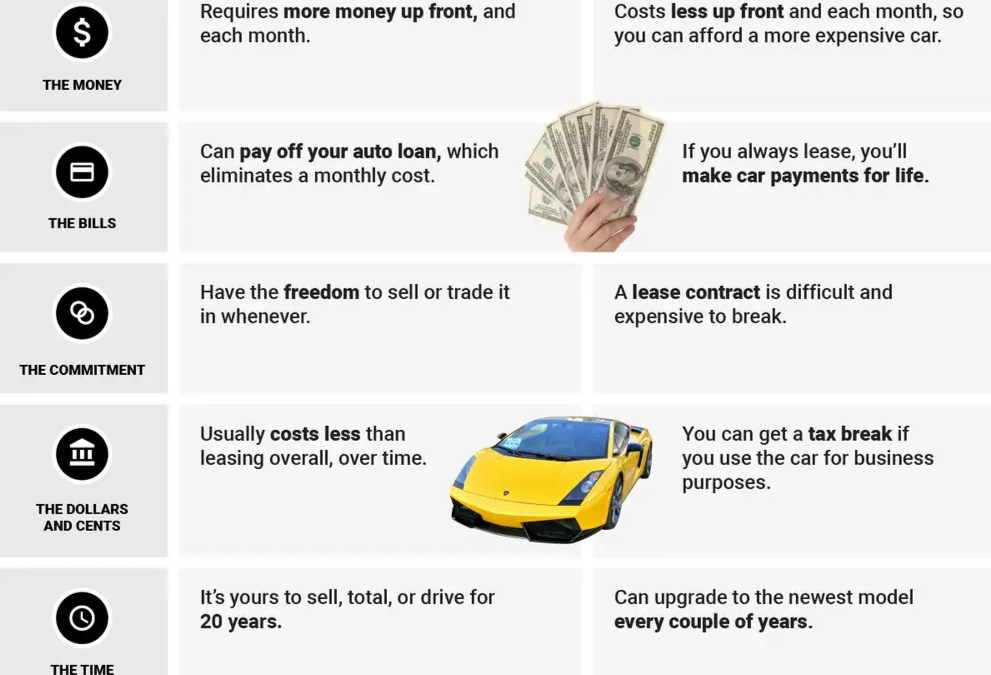

Our clients always have this question: “Which strategy is best for me with my car, truck, or SUV? Should I use the mileage or actual method, lease or buy new or used?”

It’s essential to understand the TWO MAIN OPTIONS business owners must document and utilize when writing off the auto expenses.

The Mileage method is a fixed deduction amount (in cents) that you can take for every business mile you drive your vehicle for business. It includes everything you might pay for with your car (fuel, repairs, maintenance, auto payments, etc.)…except interest on the auto loan (more below).

The Actual Method allows the business owner to take all of the expenses listed above plus depreciation. However, it requires the business owner to keep excellent records, including a mileage log…yet the write-offs can be significant.