by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Apr 23, 2024 | Tax Advisory, Accounting Services, Auto Write-off, Newsletters

I was thinking about how often people rely on tax software like TurboTax, and it reminded me of a story that might interest you. Remember Timothy Geithner? When he was nominated for Treasury Secretary, it emerged that he had made some tax errors in previous years...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Sep 25, 2022 | Auto Write-off, Business Planning, Pro Tips, Tax Planning, Tax Strategy

The Inflation Reduction Act (IRA), which was just enacted, includes an expanded tax credit for electric vehicles. The IRA launched a commercial clean vehicle credit for business-use electric vehicles. And it is much better than the credit for personal-use electric...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Aug 24, 2022 | Auto Write-off, Business Planning, PPP Loan, Pro Tips, Tax Planning, Tax Strategy

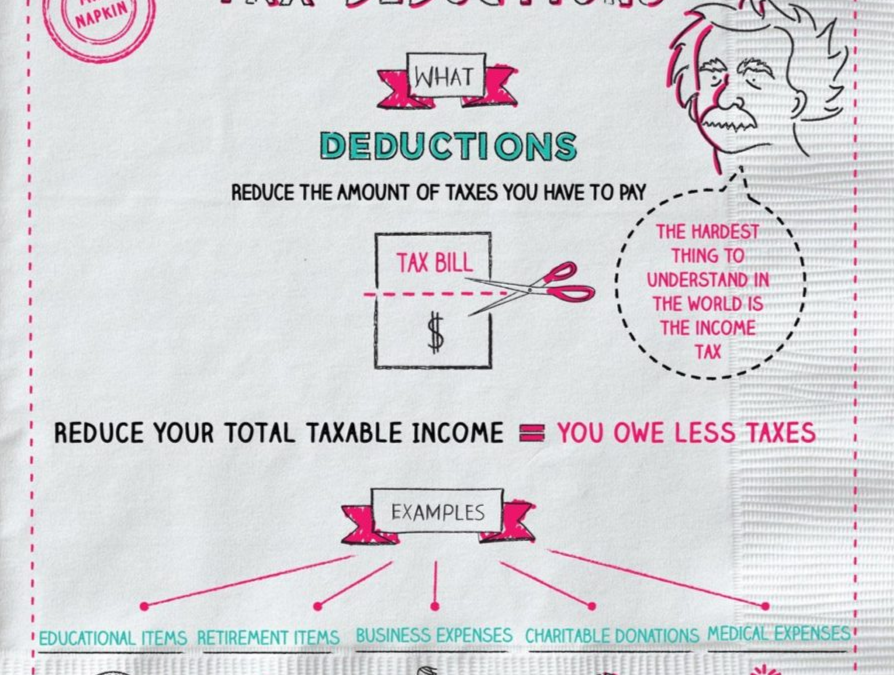

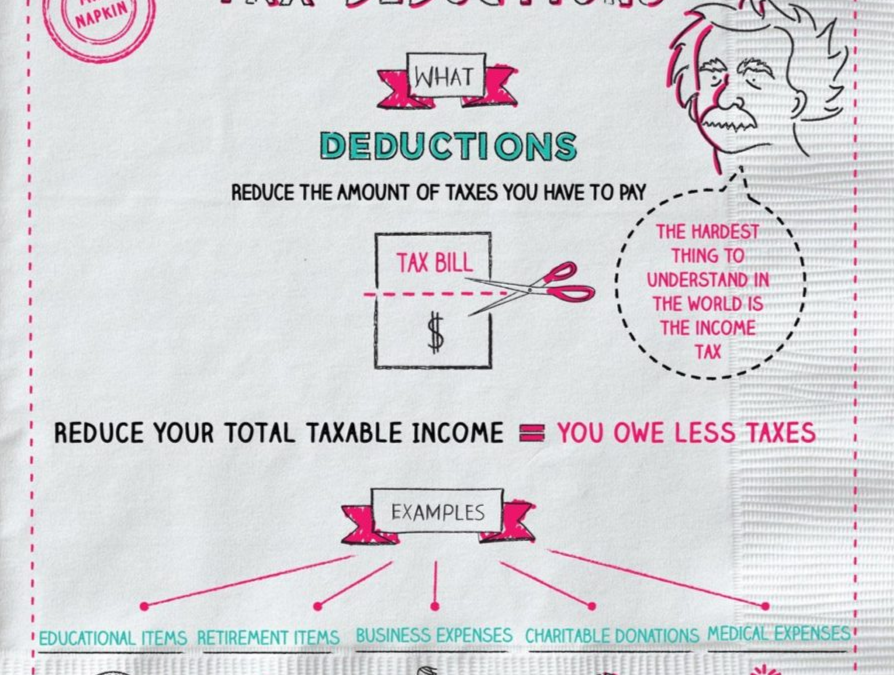

Interest on a loan is a valuable tax deduction, but it’s not always deductible. Make sure to check the rules for your specific situation. Not all interest paid on a loan is tax-deductible, and the rules for deducting interest differ depending on whether the...

by Miguel A. Palma, CPA, PFS, CGMA & Tax Advisor | Jul 19, 2022 | Business Planning, Auto Write-off, Financial Services, Palma Financial Services, Pro Tips, Tax Planning

The IRS noticed that average gas prices across the United States exceeded $5.00 a gallon and took action with higher deductible IRS gas mileage rates! Small businesses that qualify to use and do use the standard mileage rate can deduct 62.5 cents per business mile...

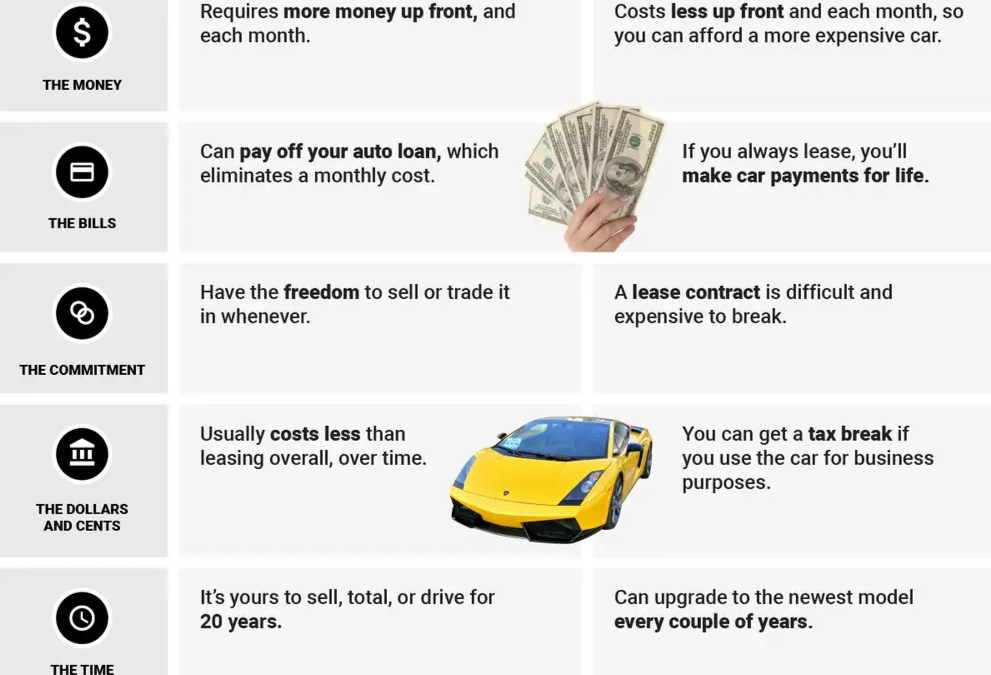

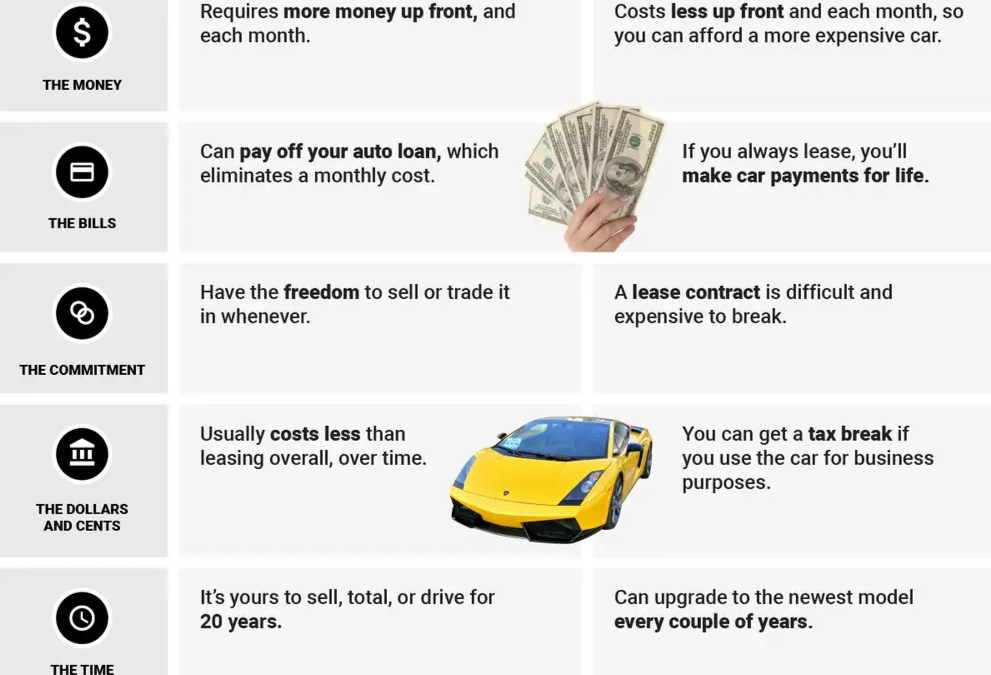

by Jackie Strack | Jun 26, 2022 | Auto Write-off, Financial Services, Palma Financial Services, Pro Tips, Vehicles

Auto Deduction has improved in the last 30 years, making it easier for business owners to get deductions. Changes became effective January 1st, 2018, under the Tax Cuts and Jobs Act (TCJA), including trucks, SUVs, RVs, and even Motorcycles. The most significant...